Delivered to your inbox

Keep up with the latest through our Monthly Newsletter

Given the start of a new Tax Year for Taxable Persons, we have highlighted key information on annual washup requirements for businesses making mixed supplies below :

A Taxable Person operating a business with mixed supplies must evaluate and quantify the following Input Tax adjustments at the end of a tax year.

It is imperative to note that the abovementioned adjustments must be reported to the Federal Tax Authority (‘FTA’) in the tax period posterior to the tax year end.

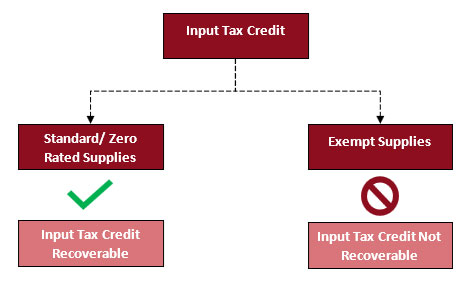

Eligibility to Claim Input Tax Credit

As per the prevailing UAE VAT Law and its associated Executive Regulations, a taxable person is eligible to claim Input Tax Credit incurred specifically for Goods and/ or Services that are utilized/ will be utilized to make taxable supplies.

Accordingly, it is then inferred that Input Tax incurred wholly or partly on procurement of Goods and/ or Services pertaining to exempt supplies would not be treated as recoverable tax in the Taxable Persons periodic VAT returns.

Apportionment of Input Tax Credit

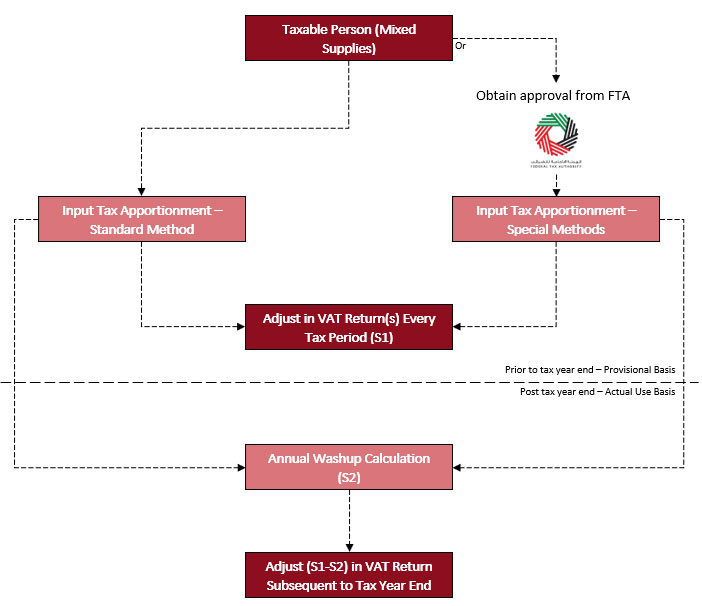

A Taxable Person engaged in the business of providing mixed supplies would be required to quantify/ calculate a proportionate amount of Input Tax eligible to be claimed in the periodic returns (to be reported on a provisional basis every tax period).

Upon the end of a particular tax year, a Taxable Person is required to conduct an annual wash-up calculation which entails revision of the provisional Input Tax apportioned in every tax period leading up to the tax year end.

Provided below is a brief summary of the necessary steps/ actions to ensure that Input Tax is apportioned accurately and is in compliance with the UAE VAT Law and its associated Executive Regulations.

Input Tax Apportionment on a provisional basis

In cases where a Taxable Person is engaged in the business of making mixed supplies, the Input Tax which is incurred for making exempt supplies will be provisionally apportioned as per the following methods (to be conducted at the time of filing VAT returns for each tax period leading up to the tax year end) –

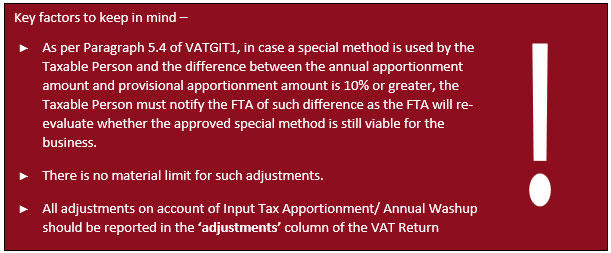

It is imperative to note that the abovementioned special method(s) can only be used upon receipt of FTA approval.

Annual wash-up

As provided above, at the end of a tax year, a Taxable Person is required to recalculate the provisional amounts (calculated in step 1 above) and derive the applicable annual apportioned Input Tax amount.

In case of any differences between the provisional Input Tax Amount and the annual calculation, the Taxable Person is required to make an adjustment in the VAT return due immediately after the tax year end. Such annual adjustments may lead to previously claimed Input VAT being paid back to the FTA or increased Input Tax recovery.

In case you would like to know more please reach out to our team of dedicated professionals.